There’s a growing gap between what we know and what we feel. We know that avoiding panic and staying in place is the best strategy during turbulent markets. History shows that patient investors are always rewarded, and market timing is a futile exercise. Yet our emotions tell us it’s time to

There’s a growing gap between what we know and what we feel. We know that avoiding panic and staying in place is the best strategy during turbulent markets. History shows that patient investors are always rewarded, and market timing is a futile exercise. Yet our emotions tell us it’s time to

Author Archives: Scott MacKillop

Posts by Scott MacKillop:

Should You Be Worried About the Stock Market’s Fringe Players?

We recently ran across an article about a little corner of the Internet known as “r/WSB.” It’s where a modern-day version of day-traders hang out to share ideas, brag about their conquests, and sometimes try to move the market to their advantage. Here’s a link to the article: The a

We recently ran across an article about a little corner of the Internet known as “r/WSB.” It’s where a modern-day version of day-traders hang out to share ideas, brag about their conquests, and sometimes try to move the market to their advantage. Here’s a link to the article: The a

You Can Act Like a Fiduciary Regardless of What the Law Says

Reg BI has now been birthed and with it a maelstrom of emotion and controversy. Fiduciary advocates are wearing black and flying their flags at half-mast. They see Reg BI as a sell-out of the individual investors the SEC was created to protect and a knife in the back of the fiduciary RIA community.

Reg BI has now been birthed and with it a maelstrom of emotion and controversy. Fiduciary advocates are wearing black and flying their flags at half-mast. They see Reg BI as a sell-out of the individual investors the SEC was created to protect and a knife in the back of the fiduciary RIA community.

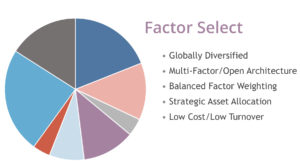

A New Series of Portfolios to Give You More Options

On April 1st (no fooling) we launched a new series of portfolios—the Factor Select portfolios. We created them in response to advisors who wanted our best ideas about how to build low cost, factor-based portfolios. A lot of work and research went into their design and we proudly offer them to give

On April 1st (no fooling) we launched a new series of portfolios—the Factor Select portfolios. We created them in response to advisors who wanted our best ideas about how to build low cost, factor-based portfolios. A lot of work and research went into their design and we proudly offer them to give

TAMP Users: Watch Out for This Fiduciary Landmine

TAMP users beware! There is a disturbing trend in our industry that may get you in trouble with the regulators if you’re not careful. Everything Was Fine Until… It all started innocently enough. In the “early days” (early 1990s) there weren’t many TAMPs, and their investment offerings

TAMP users beware! There is a disturbing trend in our industry that may get you in trouble with the regulators if you’re not careful. Everything Was Fine Until… It all started innocently enough. In the “early days” (early 1990s) there weren’t many TAMPs, and their investment offerings

Building Your Own Piece of the Future – Client Profiling

“You better start swimmin’ or you’ll sink like a stone for the times they are a changin’.” –Bob Dylan Last time we talked about how technology is changing the game for advisors. To sum up, in the future, the traditional cornerstones of your value proposition like investment managemen

“You better start swimmin’ or you’ll sink like a stone for the times they are a changin’.” –Bob Dylan Last time we talked about how technology is changing the game for advisors. To sum up, in the future, the traditional cornerstones of your value proposition like investment managemen

Building Your Own Piece of the Future – Technology

“You better start swimmin’ or you’ll sink like a stone for the times they are a changin’.” –Bob Dylan You have no need to fear the future, but you better be prepared for it. Failure to adapt to the changes that are taking place today will cause your business to sink like a stone tomo

“You better start swimmin’ or you’ll sink like a stone for the times they are a changin’.” –Bob Dylan You have no need to fear the future, but you better be prepared for it. Failure to adapt to the changes that are taking place today will cause your business to sink like a stone tomo

Stop the Dangerous Notion That Asset Management is Commoditized

This article also appears in the Journal of Financial Planning: Practice Management Blog. The emergence of low-cost investment solutions like robo-advisers and model marketplaces has elicited statements by earnest pundits about the “commoditization” of asset management. These well-meaning observ

This article also appears in the Journal of Financial Planning: Practice Management Blog. The emergence of low-cost investment solutions like robo-advisers and model marketplaces has elicited statements by earnest pundits about the “commoditization” of asset management. These well-meaning observ

The annual tsunami of prognostications about how the stock market and the economy will perform in 2018 was beginning to slow to a trickle, thankfully. Then the stock market had a major hiccup and the punditry scrambled back to its soap boxes to give us another dose. Their explanations about why the

The annual tsunami of prognostications about how the stock market and the economy will perform in 2018 was beginning to slow to a trickle, thankfully. Then the stock market had a major hiccup and the punditry scrambled back to its soap boxes to give us another dose. Their explanations about why the

This is the time of year when the gurus share their predictions and prognostications for the coming year. It is also the time of year when the media reports on how poorly the gurus fared in predicting and prognosticating about the events of the past year. The story is the same every year. As a

This is the time of year when the gurus share their predictions and prognostications for the coming year. It is also the time of year when the media reports on how poorly the gurus fared in predicting and prognosticating about the events of the past year. The story is the same every year. As a

A Surefire Way to Better Serve Your Clients and Build a Stronger Practice

Do you want to differentiate your firm from the competition, while adding value to your client relationships? Focus attention on an area that is ignored by most advisors: client profiling. Because few advisors even think of this as an area where they might add value, it presents you with a great o

Do you want to differentiate your firm from the competition, while adding value to your client relationships? Focus attention on an area that is ignored by most advisors: client profiling. Because few advisors even think of this as an area where they might add value, it presents you with a great o

The Benefits of Outsourcing: Part 2

Last month, we looked at how outsourcing the investment management can help reduce overhead costs and help you build credibility in your investment offering. This month, we’re going to look at how outsourcing can help you buy back a part of your day so you can focus on the parts of your job that t

Last month, we looked at how outsourcing the investment management can help reduce overhead costs and help you build credibility in your investment offering. This month, we’re going to look at how outsourcing can help you buy back a part of your day so you can focus on the parts of your job that t

The Benefits of Outsourcing: Part 1

Outsourcing of the investment management function by financial advisors has grown dramatically since its beginnings in the late 1980s. Depending on which studies you reference, somewhere between 25% to 50% of all advisors outsource some or all their investment management functions. That number is de

Outsourcing of the investment management function by financial advisors has grown dramatically since its beginnings in the late 1980s. Depending on which studies you reference, somewhere between 25% to 50% of all advisors outsource some or all their investment management functions. That number is de

How Advisors Can Go from Good to Outstanding

Being a good financial advisor requires mastery of a wide range of technical skills. Being a great financial advisor requires having skills as a counselor and psychologist. Being an outstanding financial advisor requires developing your skills as a teacher and coach. Here’s why. The job of a finan

Being a good financial advisor requires mastery of a wide range of technical skills. Being a great financial advisor requires having skills as a counselor and psychologist. Being an outstanding financial advisor requires developing your skills as a teacher and coach. Here’s why. The job of a finan

Announcing Our New Master Class Program

We are very excited to announce the launch of our new Master Class program. It is a monthly webinar series designed to give you access to industry experts who can help you: Run your business more efficiently Grow your business more effectively Add more value to your client relationships Position you

We are very excited to announce the launch of our new Master Class program. It is a monthly webinar series designed to give you access to industry experts who can help you: Run your business more efficiently Grow your business more effectively Add more value to your client relationships Position you