Growth and Value: Understanding Investment Styles

Investment Management, Scott's Column

Growth and Value: Two Styles of Stock Investing

Stocks are often grouped into two distinct categories or “styles:” growth and value. Knowing the differences between the two and how to incorporate them into a portfolio can help investors smooth out the ride toward their long-term financial goals.

Growth and Value Defined

Growth stocks are stocks of companies that are priced higher than the broad market based on some measure like price-to-earnings, price-to-book, or price-to-sales. They are often priced higher because they’ve had strong earnings growth in the past and are expected to have better-than-average future growth potential, although that growth potential may not materialize.

Because their stock price is so dependent on strong future growth, any small change in future expectations for one of these stocks can lead to very large price changes. As such, growth stocks tend to be more volatile than the broad market.

Value stocks are stocks of companies that are priced lower than the broad market based on some measure like price-to-earnings, price-to-book, or price-to-sales. They may be priced low based on the poor performance of the company or because the market fails to currently appreciate the underlying value of the firm.

Value stocks are generally less volatile than growth stocks, although not over all time periods.

The Rationale and the Risk

Growth stock investors expect the strong earnings growth of the companies in which they invest to continue in the future and, perhaps, even exceed the market’s expectations for them.

The risk is that the earnings growth of those firms will falter, or that the market will go through a period where it places less value on—that is, will pay less for—earnings growth.

Value investors buy stocks that are cheap with the expectation that their share prices will increase when the market recognizes the full potential—that is, the value—of the stock’s issuer.

The risk is that the stock is priced cheaply for a good reason, or that the market fails to recognize the full potential of the firm within a reasonable period, if ever.

Performance of Growth and Value

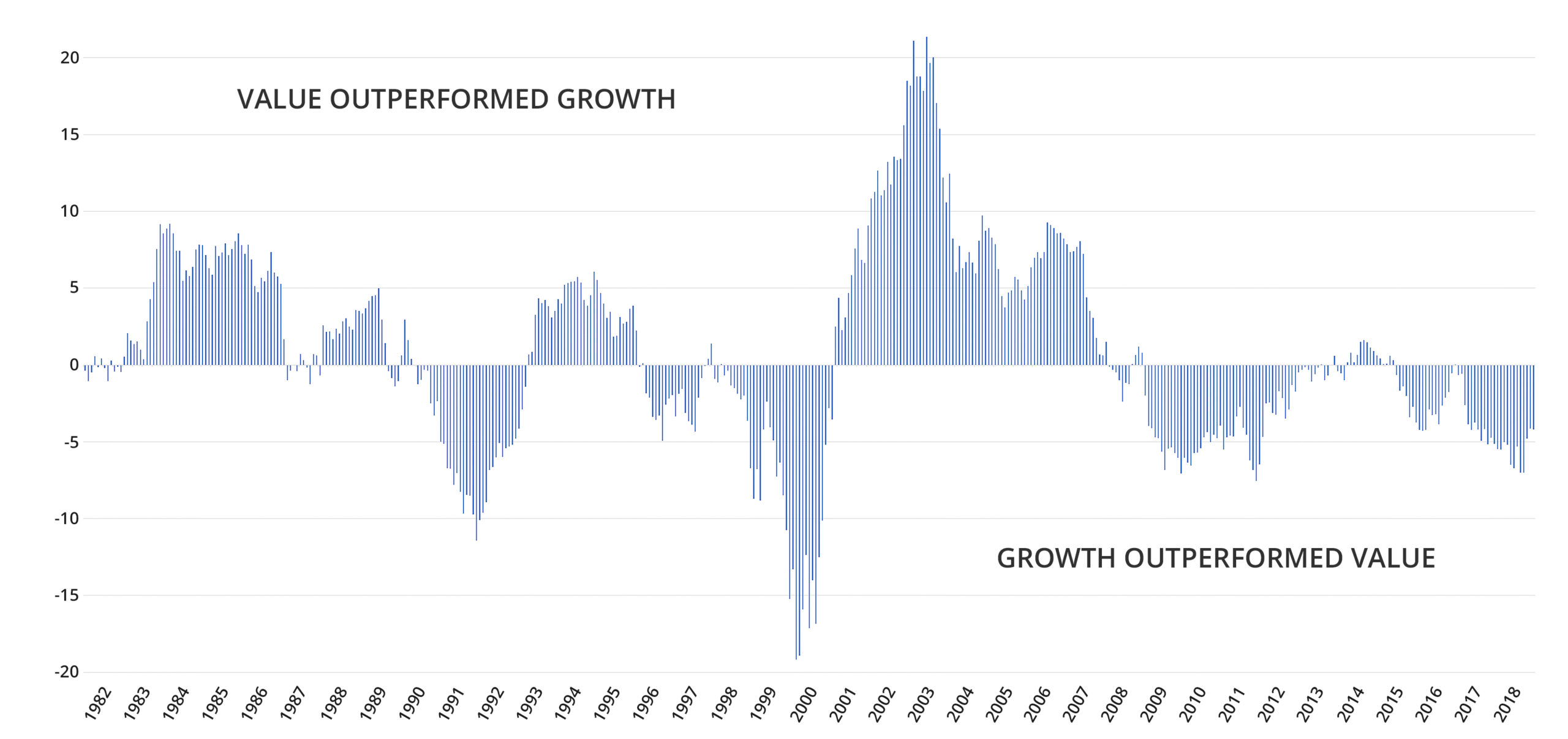

Historically, growth stocks and value stocks have outperformed each other in hard to predict cycles. Recently, growth stocks have had the advantage. Between 2009 and 2018 growth stocks produced an annualized return of 15.3% compared to 11.2% for value stocks.

Viewed in a broader context, value holds the advantage. Of all 3-year periods between 1979 and 2018, value has “won” slightly more than half of the time (51%). Over that period, value produced annualized returns of 11.7%, while growth produced annualized returns of 11.1%.

Value vs. Growth Stock Returns

3 yr. Rolling

Russell 1000 Value vs Russell 1000 Growth. Data Source: Morningstar

Whether value’s historical edge over growth will continue is the subject of much debate. There is certainly research to suggest that it will. Time will tell. However, history firmly teaches us that growth and value are likely to go in and out of favor over the coming years.

Given this cyclicality of performance, it may be tempting to try to time investments in growth and value to correspond to their respective periods of outperformance. While there is some research to suggest that growth and value perform better in certain market or economic conditions, there is no evidence to suggest that this information can be used successfully to time investments in growth and value over the long term on a consistent basis.

Rather than attempting to time investments in growth and value, here are two more reasonable approaches:

1. Maintain a portfolio weighting to growth and value that approximates their respective weights in the broad market.

2. Maintain a slight to modest tilt toward value based on the research that suggests that it may continue its historic long-term edge over growth.

What is clear, though, is that including exposure to both growth and value stocks can help in properly diversifying a long-term portfolio.