Related Resources

You only have so many hours in the day. How are you going to spend them?

Here are some facts that might help you decide:

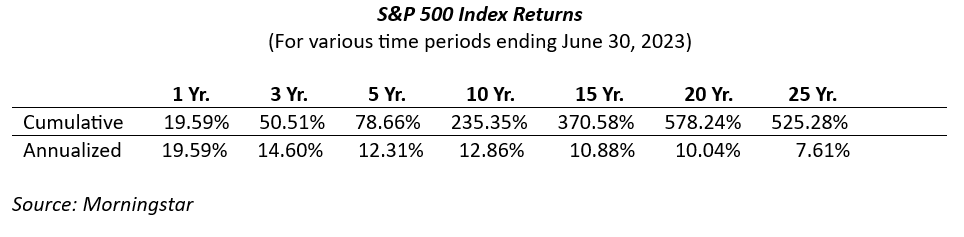

Shown below are the returns of the S&P 500 Index for the last 25 years, over various time periods ending June 30, 2023. Both cumulative and annualized returns are presented.

Source: Morningstar

Notice any trends or patterns? How about the obvious fact that Mr. Market provided healthy returns over time to those who were patient. And he didn’t need any help from you.

Everyone who has ever invested in Mr. Market at any time in recorded history, except for those who started investing at the end of 2021 or the first few quarters of 2022, made money.

Provided they stayed in place.

Those who haven’t made money yet will soon enough. But, again, only if they stay in place.

Are you going to enhance those returns through your brilliant stocking picking? The odds are against you.

Are you going to out-fox Mr. Market with your clever tactical asset allocation strategy? The odds are against you.

Are you going to rotate your way to glory by bouncing from one market sector to another? The odds are against you.

It’s not that you can’t pull one over on Mr. Market once in a while. But the odds of doing so consistently over the long-term are stacked against you.

Would you bet your own money playing in a game where you were almost certain to lose? Obviously, some people would. There are plenty of them in Vegas.

Would you do it with your clients’ money when their future financial security is hanging in the balance? How confident are you that you can improve on Mr. Market’s luscious recipe?

A better way to spend your time

Mr. Market’s bounteous rewards do not come for free. This we know.

During the 25-year period covered in the graphic above, there have been either four or six bear markets, depending on which source you use. There were six calendar year periods with negative returns – about once every four years.

Again, depending on the source, the average bear market downdraft was roughly -35% to -40% and the average duration was approximately one year.

Remaining undaunted through downdrafts of those magnitudes takes courage, confidence, and a frame of reference that does not come naturally to most people. To benefit from Mr. Market’s benevolence, clients must be properly prepared.

It’s like flying in an airplane. Most of the time the flight is relatively smooth. But every so often you hit turbulence. I don’t like turbulence at all, but I know not to jump out of the airplane to avoid it. I know I have to get my head in the right place and grit through it.

I’ve flown on hundreds of flights, so I’ve had many chances to learn what to do when turbulence hits. I’m much better at dealing with it. I keep reading my book through the bumps.

But investors don’t get as many chances to learn, and the consequences of their mistakes are greater. They need guidance to understand what is happening when turbulence hits and what to do about it. They need emotional support – training alone may not be enough.

Lay the foundation for financial success

This is where advisors make a difference.

Teach clients about the dynamics of the stock market – always up over the long-term, sometimes (really) bumpy over the short-term. Not so they can become great investors themselves, but so they can behave as successful investors. Don’t jump out of the plane.

Lay the groundwork for good investor behavior before the turbulence starts. There’s a reason they teach soldiers to shoot on a firing range and not in the heat of battle.

Reinforce the lessons over time. You don’t become a good driver on your first day of training. Becoming good at anything requires repetition. It takes time to build skills and confidence.

Don’t imagine that you are Harry Markowitz teaching finance to a room full of graduate students. You are talking to people who are ignorant about investing for a reason. They don’t find this stuff interesting, and they don’t want to hear you drone on about it.

Keep the message short and entertaining, if possible. Deliver it in small, bite-sized doses. The goal is not to demonstrate your vast knowledge of investing, but to impart a small bit of it to someone who is probably a little scared and reluctant to admit their ignorance.

Measure your success by monitoring your clients’ reactions during difficult times. Are they comfortable in situations that make most people uncomfortable? Are they still reading their book while the airplane is bouncing around?

Be there for your clients. No matter how good their training is, most investors need some support when the going gets tough. If you are off tweaking their portfolios and trying to bob and weave your way through the markets, you will have less time to perform this valuable service.

If you think your clients are already financially savvy, you are probably overestimating their knowledge level. The stats on financial illiteracy in this country are alarming. The US ranks 14th worldwide in financial literacy, right after Singapore and the Czech Republic.

Good for you, good for them

None of this should be news to you. But it’s easy to get distracted when you are bombarded by sales pitches disguised as prescriptions to cure whatever bedevilment the market is offering up.

By focusing more on your clients and less on their portfolios, three good things will happen:

Your clients will appreciate the attention and feel listened to. This will improve their client experience (excuse the buzzword).

You will set yourself apart from many of your competitors in a positive way. This should increase client retention and enhance the flow of referrals.

Keeping your hands off the portfolio management joystick will help you avoid mistakes that will be embarrassing to you and disappointing to your clients. Let Mr. Market do more of the work.