The Importance of Sticking It Out

What a month!

As the markets racked up the first full year in history with 12 months of positive stock market returns, the tension that’s been building for many investors throughout 2017 finally broke. To buck the trend, February of 2018 brought us the two largest single day point drops in the history of the Dow Jones Industrial Average (February 5th and 8th). Note these are point drops. In percentage terms these days don’t even make the top 20, but that sounds much less dramatic for a headline.

For many investors, that tension has been replaced with the fear and uncertainty about whether markets will continue to drop and how they should respond to this return of volatility. Should they get out before the market drops even further? Is this the beginning of the end, or just another bump in the road?

Times like these are when many advisors dust off their version of the chart below, which illustrates what happens if you stay invested in the market market throught the tough times vs. getting out and risking missing the rallies on the best market days. Below is a version I like from a blog post by Michael Batnick, CFA, on MarketWatch.

Illustration from Michael Batnick, CFA, in his 2016 MarketWatch blog post.

Still, investors may ask, “what if we miss the 25 worst days, too?” Well, in that case, you’d be in great shape. The difficulty, of course, is that no one knows when those days will occur. Furthermore, getting out following a period of bad performance may be the worst time to do so.

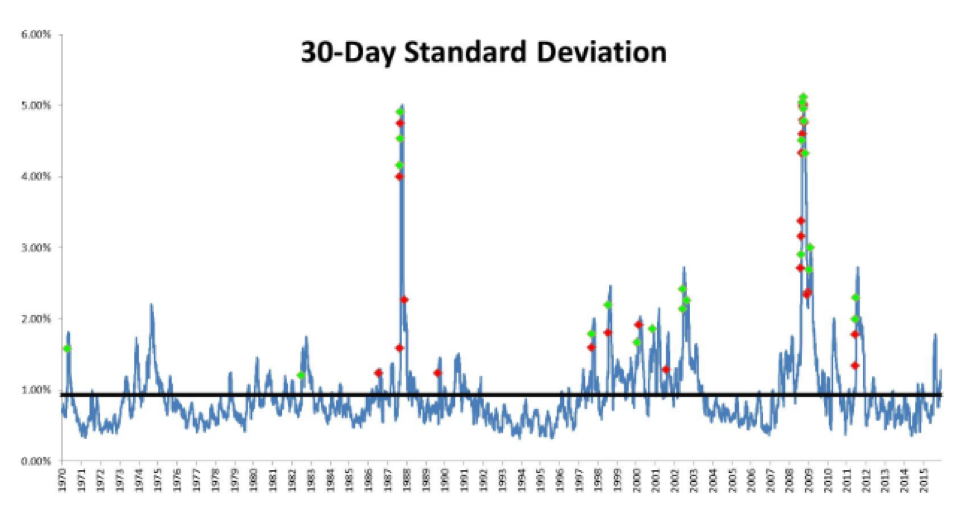

The chart below (also a great illustration put together by Michael Batnick) shows the best 25 days for the S&P 500 in green and the worst 25 days in red. The best and worst days often occur close together during periods of heightened volatility. Getting out because you’ve experienced volatility or a market drop means you may miss the recovery.

Illustration from Michael Batnick, CFA, in his 2016 MarketWatch blog post.

So how did this play out in February? Well, if an investor pulled out of the market following that market drop on the 5th, they would have missed the 4th largest single day gain ever in the Dow on the 6th. Likewise, if they’d tried to time the market and pulled out after that market drop on the 8th, they would have missed the 410-point gain in the Dow on the 12th (only 19th largest in history, but it still felt good).

In fact, at the time of this post (3/2/2018), despite the drama, the S&P 500 is still positive 0.66% year-to-date. That’s not a bad start to the year for long-term investors.