Special Market Commentary

“Pain is temporary. It may last a minute, or an hour, or a day, or a year, but eventually it will subside and something else will take its place. If I quit, however, it lasts forever.” Lance Armstrong

It finally arrived. We knew it was coming at some point, but as usual we didn’t know when, what it would look like, or what would trigger it. Despite the news media’s claims to the contrary, they don’t really know what triggered it either. To put the decline into context, when looking at our model portfolio returns through Friday’s (2/9/2018) close, they are essentially back to where they were in mid-December.

The trading activity over the last several days has clearly shown a reversal of the “goldilocks” environment of the recent past. Volatility has spiked, and on Thursday (2/8/2018), the S&P hit the technical definition of a correction (-10% drawdown). This is more akin to what normal markets look like, although that doesn’t make it sting any less or cause any less anxiety for investors who have become accustomed to the smooth upward ride we’ve been on.

From an economic perspective, we see very little change to the trends we have been observing over the last year. Earnings growth continues be strong, growth is improving, unemployment rates are low and have held steady just above 4%, while inflation remains modest.

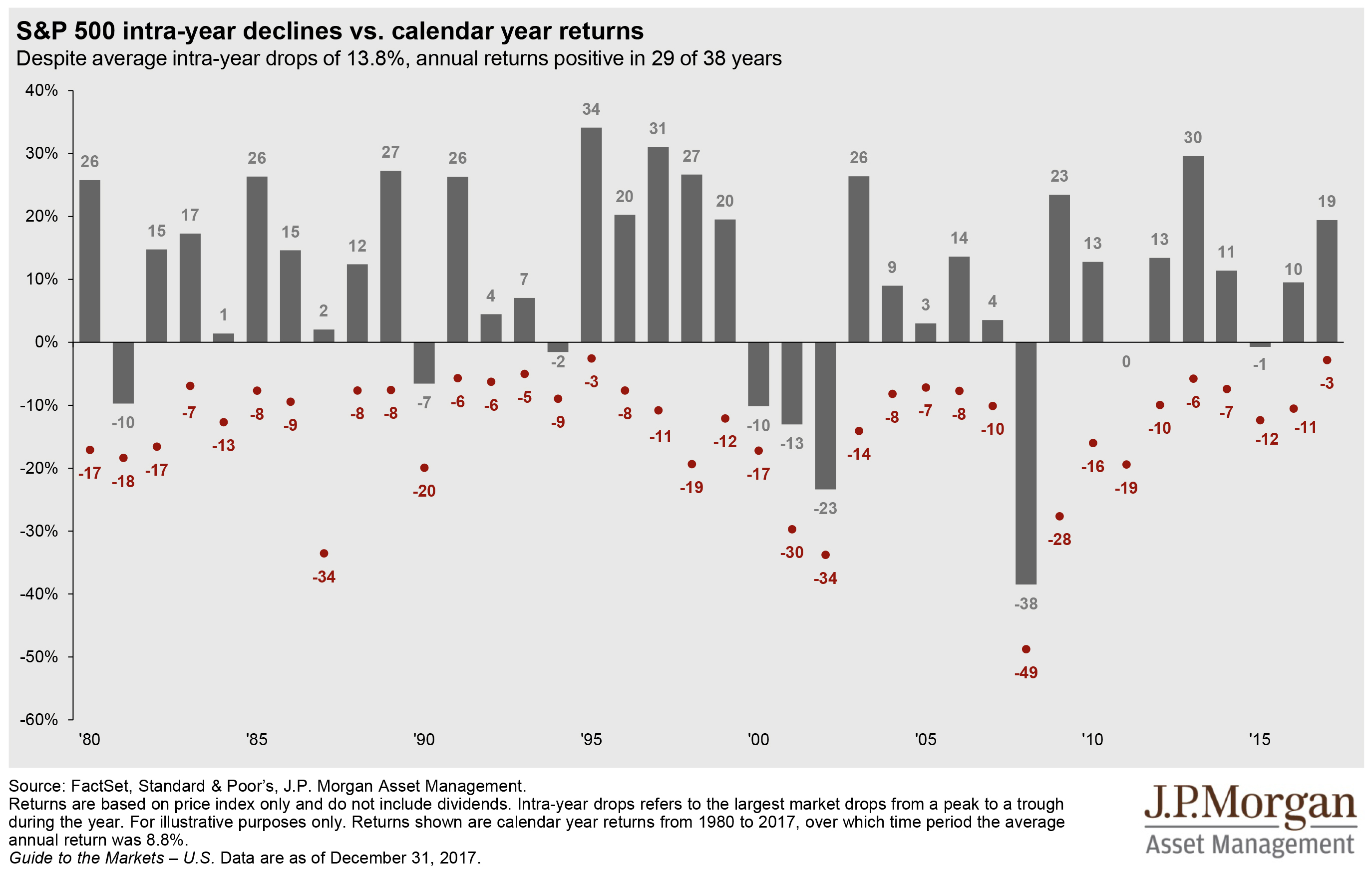

We often use the following illustration from JPMorgan’s Guide to the Market, which shows historical intra-year drawdowns for the S&P 500.

If history provides any guide, clients should anticipate that equity markets will roughly experience:

- 10% losses every year

- 10-20% losses at least once every two to three years.

- Greater than 20% losses at least once every five to six years.

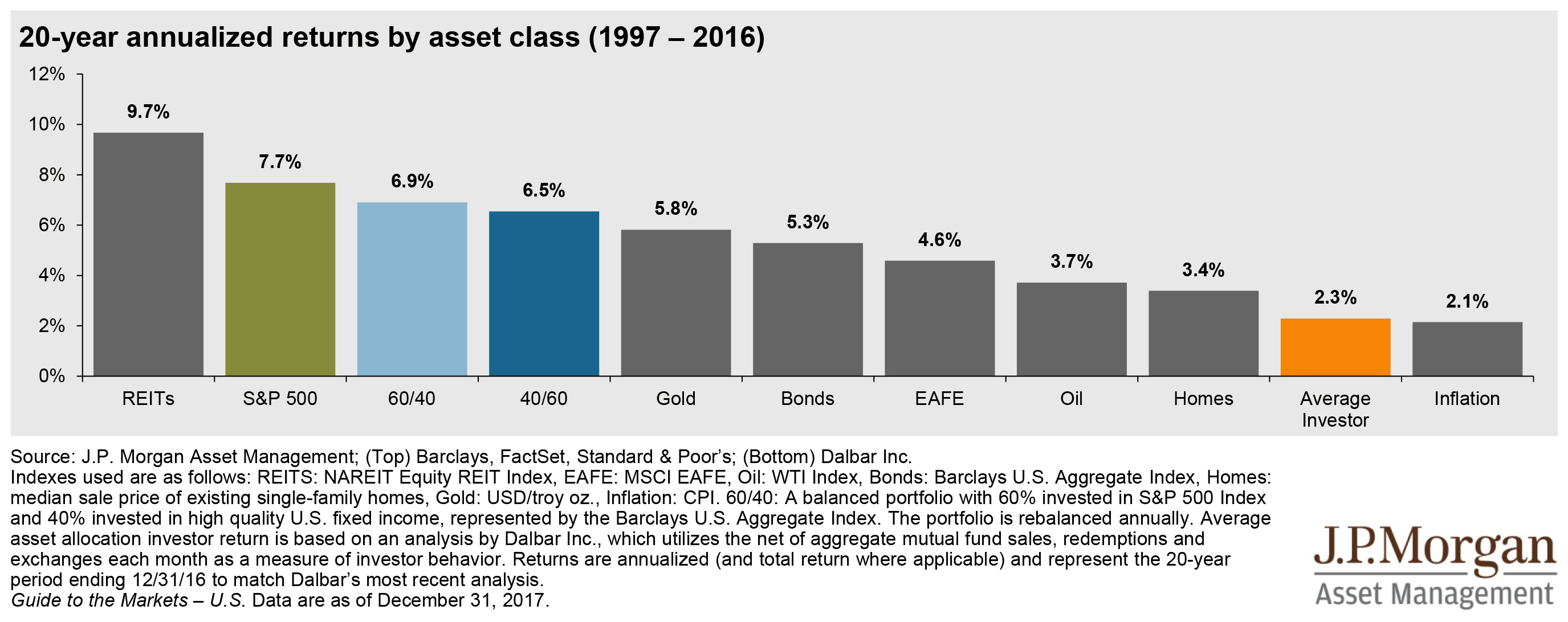

As you know, at First Ascent, we believe in long-term investing and that timing the market is a futile effort. The following is a graphic that summarizes the findings of the Dalbar study on average investment returns.

From here you can see that the “Average Investor” would have been better served over the past 20 years by not trying to time movements in and out of asset classes, but rather simply staying invested. In fact, they would have been better off just staying in any single asset class as opposed to trying to switch between them. Emotion can be very powerful during times of market turbulence, but having a disciplined investment process helps relieve our natural tendencies to react.

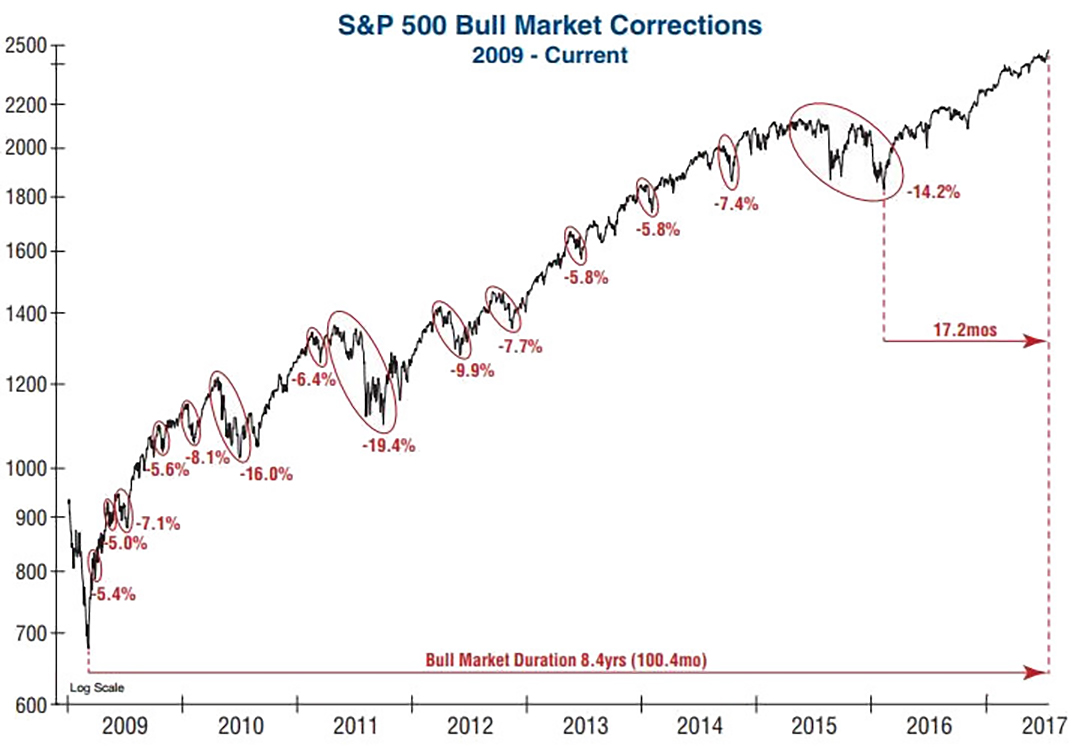

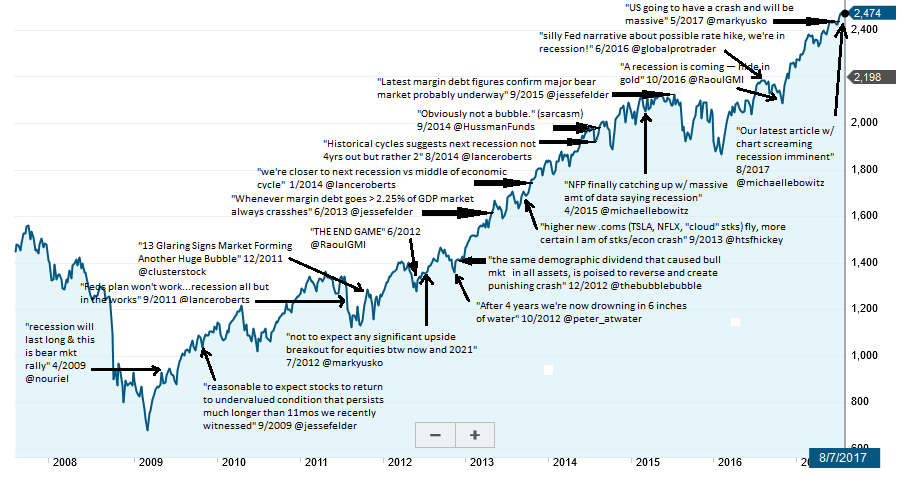

While we certainly do not know the future, we can look at the past and recall the path we’ve traveled to arrive at where we are today since the 2008 Great Financial Crisis. These past corrections were painful as well, but nonetheless were clearly not a signal to abandon a well-defined and disciplined plan.

Turning to the “Experts” and the news media. Our message would be to just TURN IT OFF.

The news media is not interested in actually relaying facts or helping investors reach their goals. They are trying to generate interest, clicks and viewership. And what sells better than fear?

We surveyed some major news sites on Monday after the market drop and the term fear-mongering came immediately to mind. The visuals: red lines, stress, declines, anxiety. The verbiage: historic plunge, meltdown, terrifying.

None of this is helpful for investors. Again, please just TURN IT OFF.

None of this is helpful for investors. Again, please just TURN IT OFF.

Finally, we really like this chart, which illustrates numerous market experts’ dire predictions over the recent past, all of which if heeded would have been detrimental to investors long-term success:

In closing, Bob Veres, an industry thought-leader we hold in high regard, suggests now is a great time for a little exercise that perhaps we would all be well-served to try:

“It’s possible that the markets will drop further—perhaps even, as we saw during the Great Recession, much further. Or, as is more often the case, they may rebound after giving us a correction that stops short of a 20% downturn. The rebound could happen as early as tomorrow or some weeks or months from now as the correction plays out.

Once it’s over, no matter how long or hard the fall, you will hear people say that they predicted the extent of the drop. So now is a good time to ask yourself: do I know what’s going to happen tomorrow? Or next week? Or next month? Is this a good time to buy or sell? Does anybody seem to have a handle on what’s going to happen in the future?

Record your prediction, and any predictions you happen to run across, and pull them out a month or two from now.

Chances are, you’re like the rest of us. Whatever happens will come as a surprise, and then look blindingly obvious in hindsight. All we know is what has happened in the past. Today’s market drop is nothing more than a data point on a chart that doesn’t, alas, extend into the future.”