The Impact of Low Fees

Fees are a primary consideration here at First Ascent. You’ve probably heard of our flat portfolio management fee, which is the first of its kind that we know of. Beyond that, we are always focused on managing the transaction costs and internal expenses of our portfolios.

While we believe a penny saved is a penny earned like any good investor, it’s not just about being thrifty. We believe that over the long-term, low fees can make a really big difference.

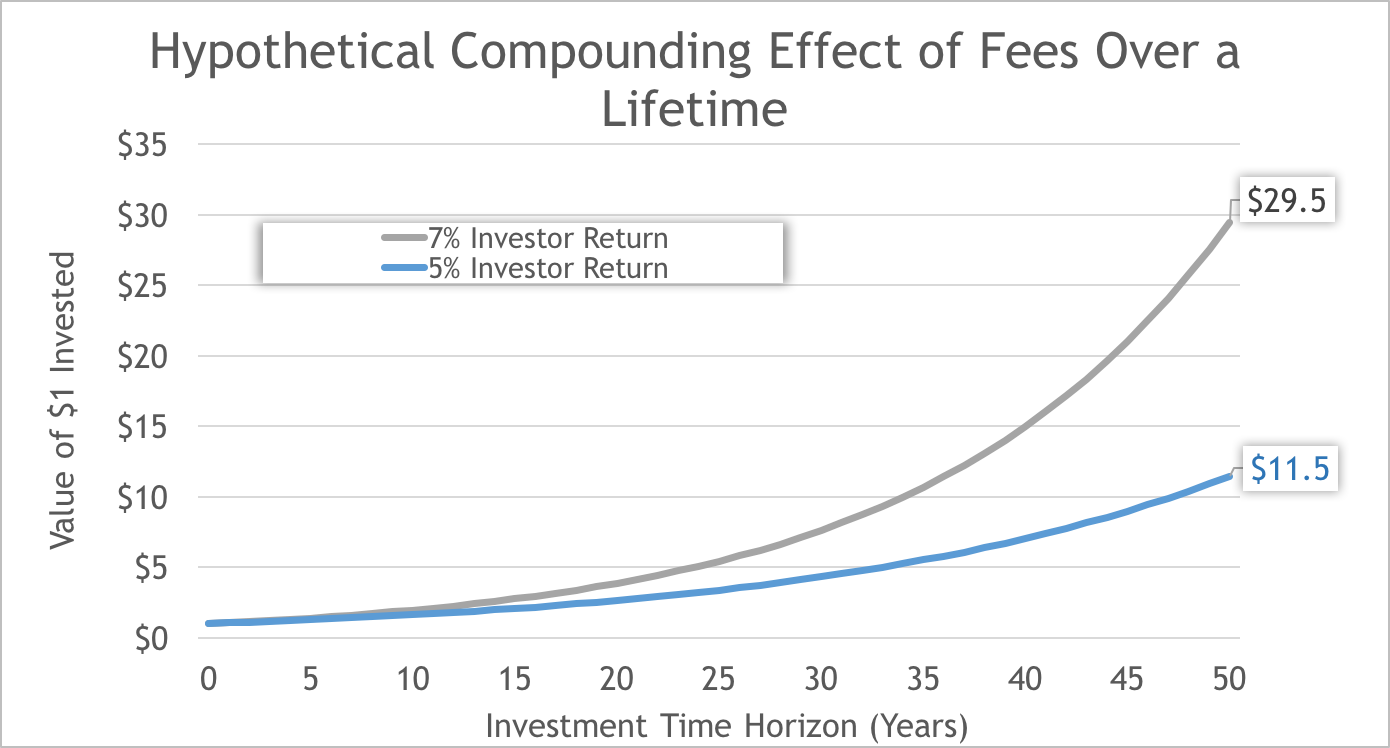

Recently I watched an interview with Jack Bogle, the founder of Vanguard. He made a statement about the impact of fees that I almost didn’t believe. He said that if you take an investment and grow it for 50 years at 7%, $1 could become nearly $30. The 50 years might be a reasonable proxy for a “lifetime” investment portfolio if you take someone in their 30s who may live into their 80s (or longer).

Bogle went on to explain that if there is a 2% annual difference between what the market earns and what the investor gets (either through fees, transaction costs, unnecessary tax impact, etc), and the value compounds at only 5%, then the net impact is that the same $1 only grows to $11.50 over the same 50-year time period.

He sums up his thoughts by asking if it is reasonable for an investor who puts up all of the capital and takes all of the risks, to only end up with around 1/3 of the growth that was possible? We don’t think so either.

Now clearly this example is just hypothetical and doesn’t take into account client goals, actual investment decisions, market volatility, or other important factors. However, I found the illustration both astounding and enlightening.

Another way to look at this is to highlight the potential benefits and value that financial advisors and following a disciplined investment approach can bring to clients’ success. Numerous studies have shown many individual investors do not capture full market returns due to things like return-chasing or making emotional decisions. The education and coaching that advisors provide has the opportunity to move clients meaningfully up the right-hand side of the chart, increasing the likelihood of attaining their goals.

While we ultimately have no control on the exact return the markets provide, at First Ascent we can and do focus on the things we are able to control, like costs, expenses and turnover in our portfolios. And those are things that really can make a big difference.