Related Resources

Have any of your clients asked you why their portfolios have allocations to international equities? If they haven’t yet, you should expect that they soon will. Here’s why.

The U.S. stock market has beaten international markets like a drum for the last 10 years—longer than the investment memories of most clients. The U.S. market has been the winner in eight of the last 10 years. The cumulative return for the S&P 500 index was 257% vs. 71% for the MSCI EAFE index over that period. The S&P’s annualized return was 13.56% vs. 5.50% for EAFE.

Add to that the fact that many U.S. investors already have a natural home country bias based on their relative familiarity with our domestic markets. Then mix in the dangers, chaos and uncertainty permeating the world today. Quite a recipe for anxiety and discomfort.

Is it any wonder clients might be questioning the wisdom of diversifying a portfolio between U.S. and international stocks? You might be asking yourself the same question.

Despite the U.S. market’s recent superiority over international markets in recent years, there are still some good reasons a portfolio should include international investments.

A World of Opportunities

International markets provide a wide range of investment opportunities for U.S. investors.

In 1970, the U.S. stock market represented two-thirds of the global market, as measured by market capitalization. Now it represents just a little over half of the global stock market.

International markets represent 85% of global GDP. The U.S. comprises the remaining 15%.

When Forbes published its 2019 list of the largest 2,000 public companies, only 575 of them were based in the U.S.

In Kantar’s recent listing of the Top 100 Most Valuable Global Brands, 46 were non-U.S. companies. The list included many non-U.S. brands that are well known to U.S. investors: Adidas, Alibaba, BMW, Chanel, DHL, Gucci, IKEA, Mercedes, Samsung, Shell Oil and Toyota.

By including international investments in their portfolios, investors can take advantage of the wealth of opportunities provided by leading companies in developed and emerging markets.

What Goes Up Must Come Down

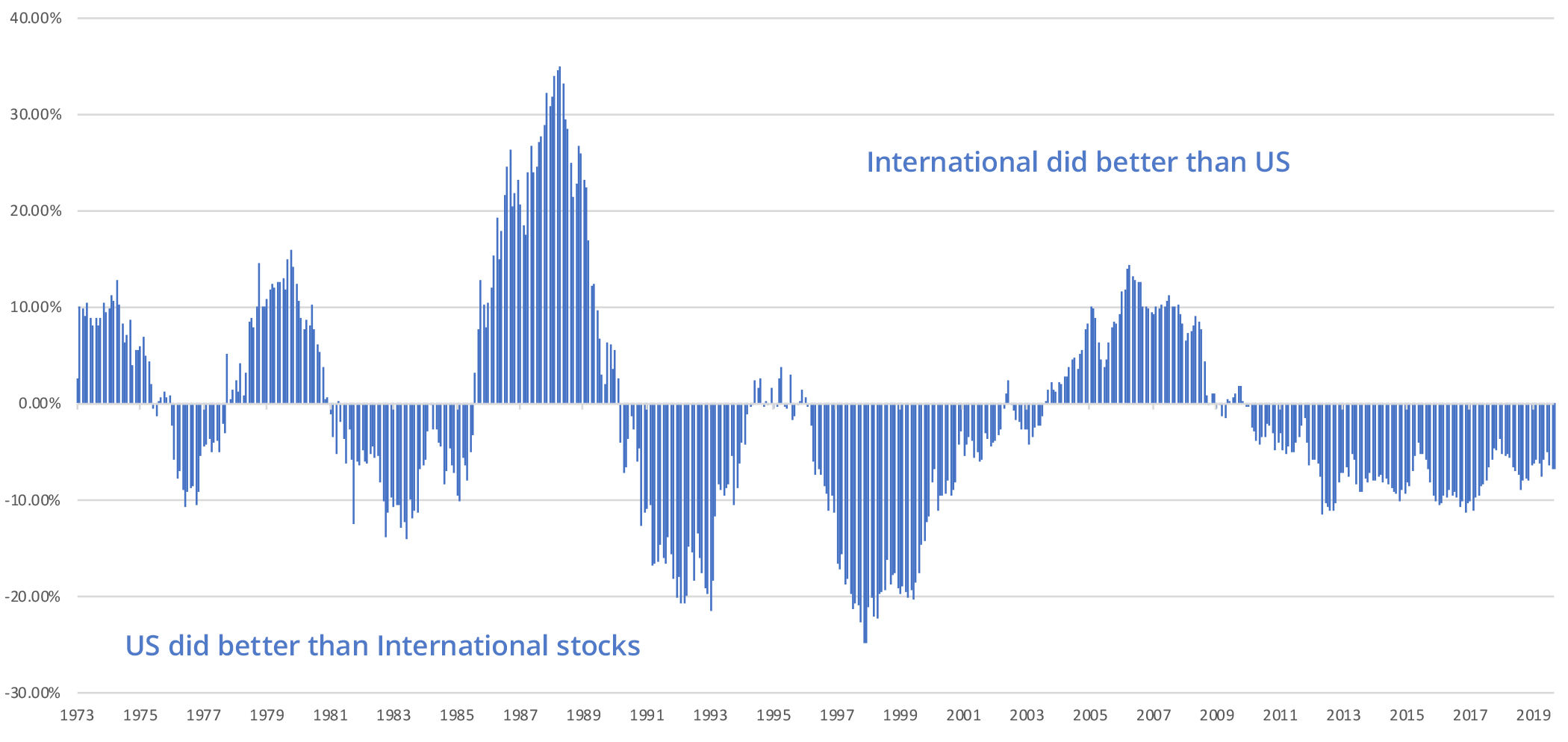

Historically, U.S. and non-U.S. stocks have outperformed each other in impossible-to-predict cycles. Since 1970, non-U.S. stocks have outperformed U.S. stocks just over 50% of the time based on an examination of 3-year rolling returns.

International vs. U.S. Stock Returns

3 Yr. Rolling Returns

Data Source: Morningstar

In the recent past, the U.S. market has had a good run relative to international markets. But many experts believe the future return outlook for international markets is superior to the U.S. market.

In 2019, Vanguard projected that non-U.S. stocks are likely to return 8.4% over the next 10 years, while the U.S. market is likely to return only 5.1%. This research is consistent across many other organizations including BlackRock, Envestnet, J.P. Morgan, Callan, and Invesco. Their research forecasts that international stocks will outperform the US market over the next 10+ years.

No one knows for sure how markets will perform in the future, but including international investments in a portfolio ensures investors will always have exposure to the markets that are performing the best.

In addition, since U.S. and international stocks do not move up and down in perfect lock-step, adding both to a portfolio can have a dampening effect on portfolio volatility.

Timing Is Not an Option

The world is full of uncertainty and negative events that cause investors to ask the question, “is now the right time to invest internationally?”

Unfortunately, there is rarely a time when we see only smooth sailing ahead. What’s more, there seems to be little correlation between times of relative tranquility and periods of superior market performance. This makes it impossible to correctly and consistently predict the right time to enter into any particular world market based solely on the state of the world.

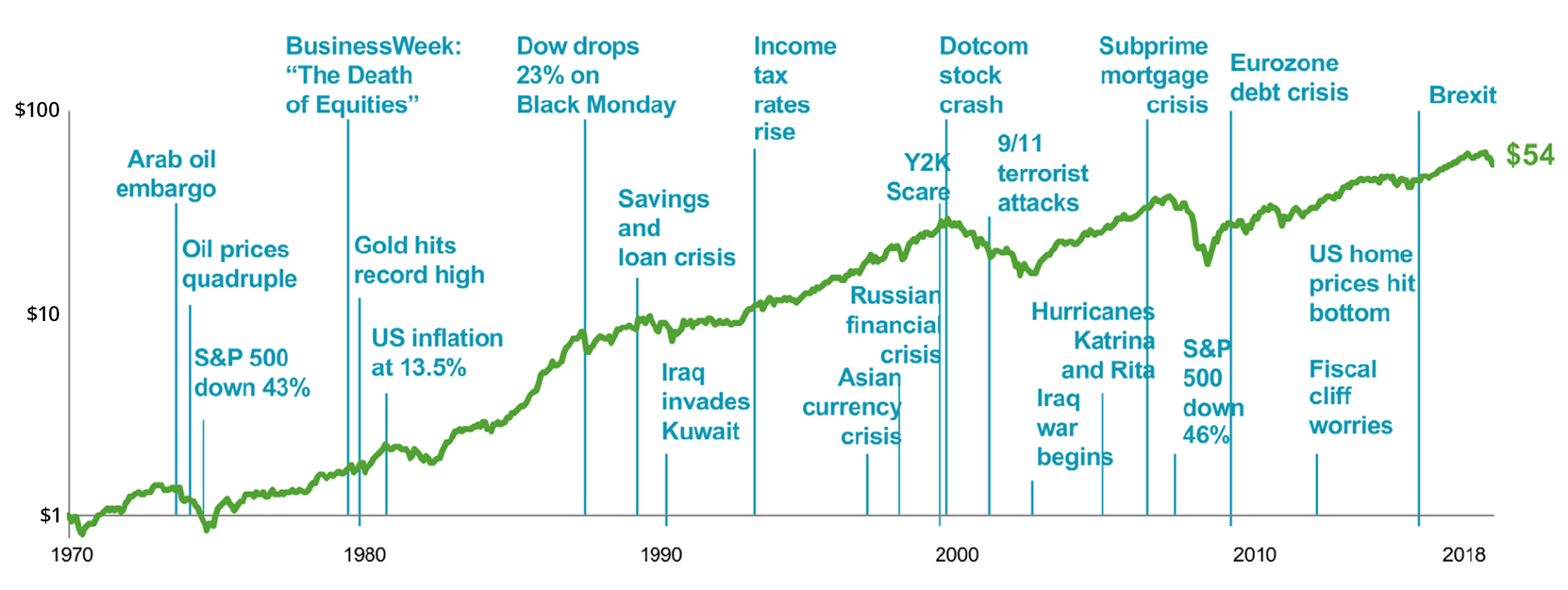

The good news for investors is, over time, markets all over the world tend to rise anyway. The graph below shows the steady increase in value of the MSCI World Index over almost 50 years from 1970 through 2018—a period that included a plethora of crises and catastrophes.

Growth of a Dollar: MSCI World Index (net dividends)

1970-2018

In US dollars. MSCI data MSCI 2019, all rights reserved. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is no guarantee of future results.

The Keys: Discipline and Patience

The message is clear. Investors cannot wait on the sidelines until the world outlook is rosy—it almost never is. The rewards come not to investors who try to avoid periods of turmoil, but to those who are prepared for them.

International markets will have their day again, just as they have in the past. The benefits of global diversification are clear. The patient and disciplined investor will experience them.