Related Resources

An Elusive Dream

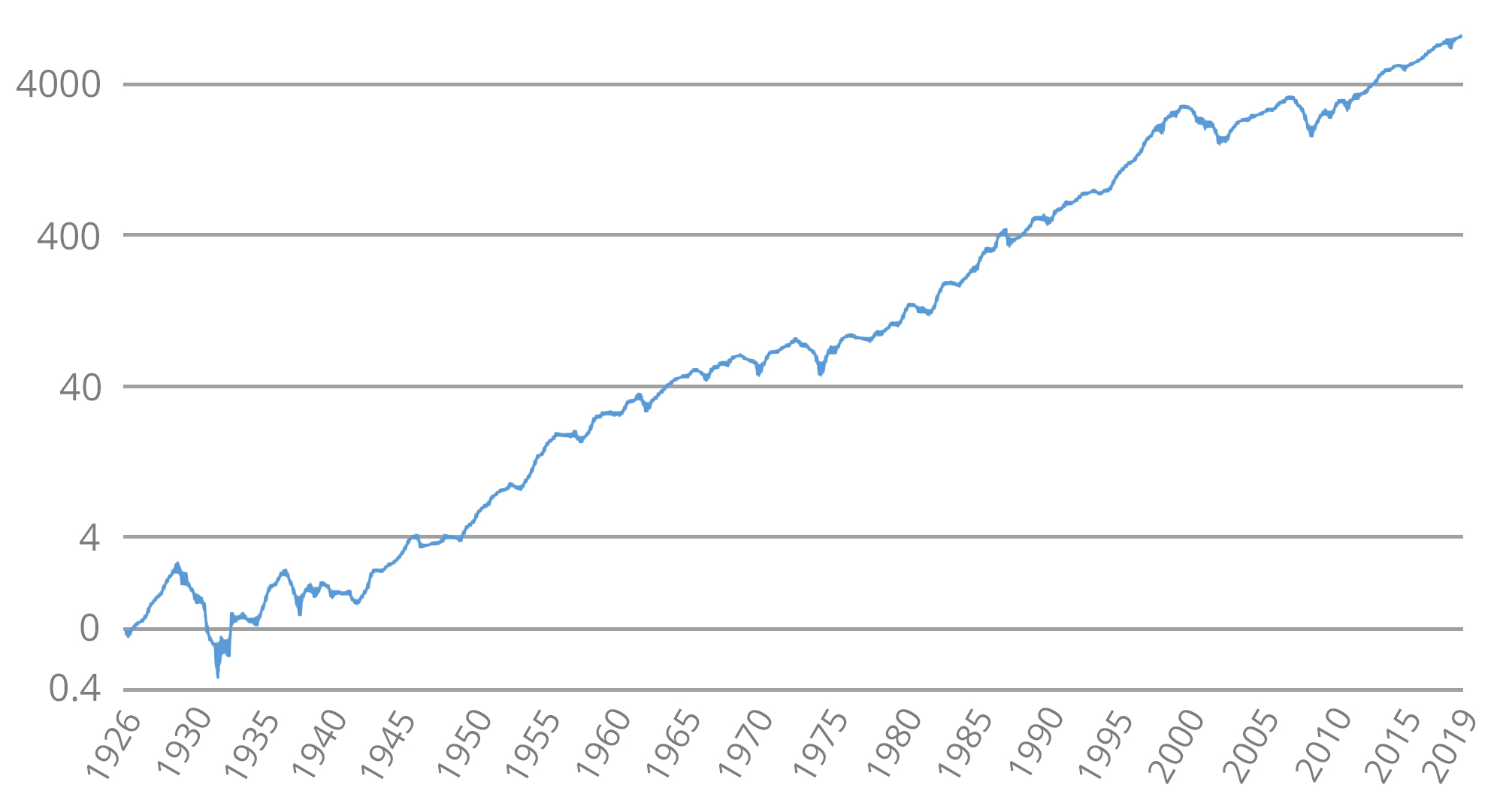

The stock market goes up and down, but over the long-term, the trend is strongly upward. Looking at the market’s rise from this perspective masks an ugly reality.

Growth of the U.S. Stock Market

1926-2019

US Stock Market as represented by the Ibbotson SBBI US Large Stock index. Growth is shown on a logarithmic scale to more clearly highlight growth through history. Data Source: Morningstar.

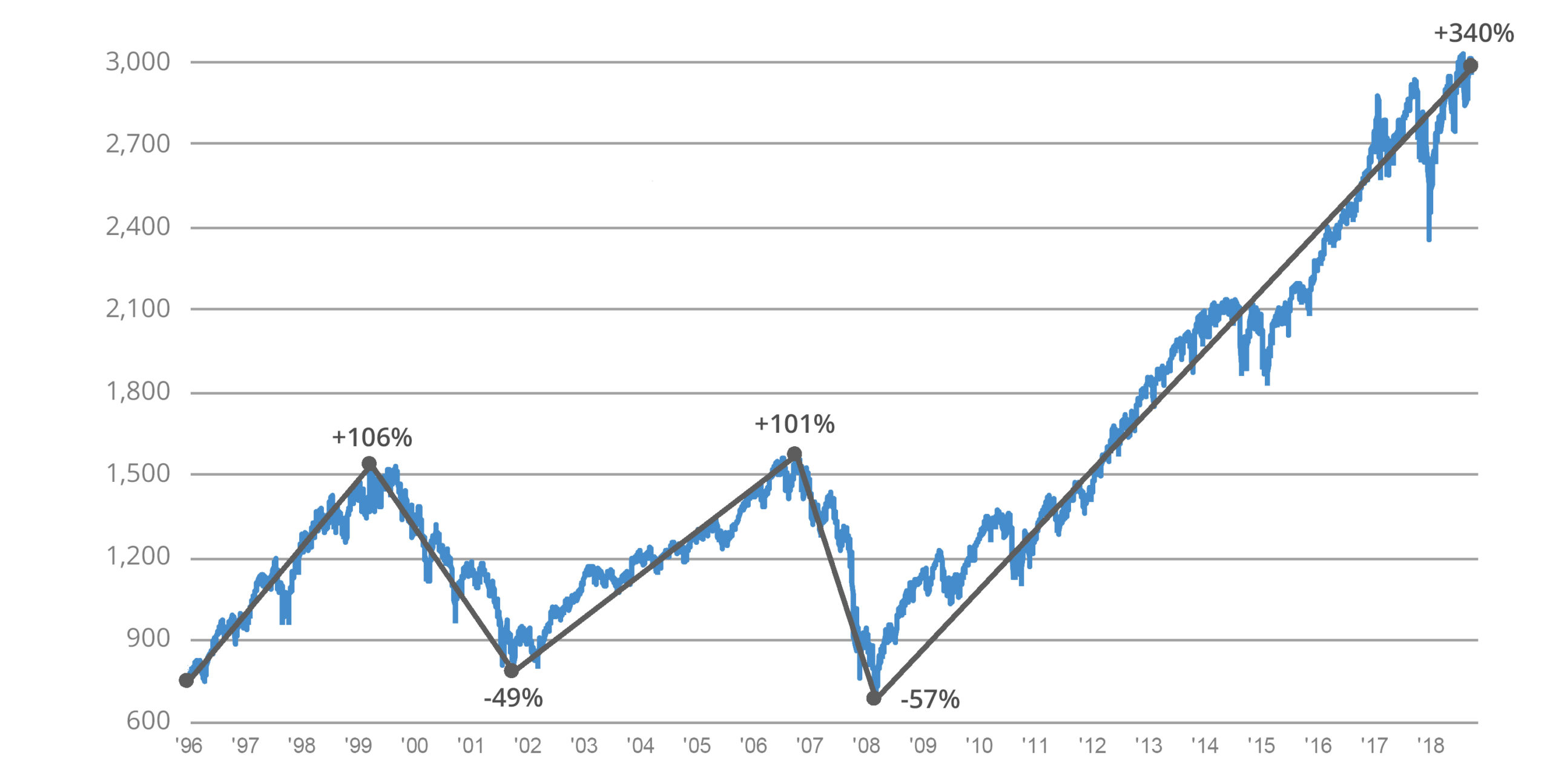

A closer view shows that the market line often resembles a jagged saw blade that can cut the heart out of even the most seasoned investor.

Growth of the U.S. Stock Market

1996-2018

Source: Compustat, FactSet, Federal Reserve, Standard & Poor’s, J.P. Morgan Asset Management. Dividend yield is calculated as consensus estimates of dividends for the next 12 months, divided by most recent price, as provided by Compustat. Forward price to earnings ratio is a bottom-up calculation based on the most recent S&P 500 Index price, divided by consensus estimates for earnings in the next 12 months (NTM), and is provided by FactSet Market Aggregates. Returns are cumulative and based on S&P 500 Index price movement only, and do not include the reinvestment of dividends. Past performance is not indicative of future returns.

Everyone dreams of an investment process that has you in the market when it’s going up and gets you out when it’s going down. But, alas, such an investment process is just that – a dream.

The problem isn’t that market timing never works. The problem is that it works just enough to give you hope, but not enough to improve performance over the long-term.

There are no academic papers or rigorous examinations of market timing calls that support the consistent, long-term success of that approach to investing. There are, however, plenty that point out its shortcomings and document the hurdles to its success.

The hard facts

A 2016 article by Wim Antoons, Market Timing: Opportunities and Risk, surveyed some of this research and offered additional evidence against the efficacy of market timing. Antoons reviewed research done by the CXO Advisory Group, which collected predictions by 68 market timing gurus between 1999 and 2012. The data showed that 42 of the 68 gurus (61.8%) were accurate less than 50% of the time.

Antoon studied the CXO predictions for the period 2005 through 2012 – a total of 6,582 forecasts – and found that “after transaction costs, no single market timer was able to make money.” These results led Antoon to conclude: “There are two kinds of investors: those who don’t know where the market is going and those who don’t know what they don’t know.”

Other studies cited in Antoon’s article support this conclusion.

It should be simple

Market timing seems like it should be simple because – like flipping a coin – there are only two alternatives. Either you are in the market or you are out of it.

But securities markets are complex adaptive systems driven by many variables. Economics, politics, acts of God, company-specific results and human behavior all play a role. It isn’t possible to consistently account for all these factors and the impact they have on the markets.

It is tempting to try to identify repeatable patterns that can serve as the basis for timing decisions, especially given the vast computing power we have at our disposal. Unfortunately, the evidence shows that finding such patterns is not a realistic expectation.

On October 19, 1987, international and U.S. stock markets fell 20% in a single day. Nobel Prize winner Robert Shiller surveyed investors to see if he could determine what drove the crash that came to be known as Black Monday. His conclusion: The crash was due to investor psychology and did not have an obvious external cause. How do you time that?

Why do we persist?

Despite the overwhelming evidence against market timing, many investors continue to search for ways to defy the odds. This search is driven by three factors: fear, overconfidence, and the fact that gurus get it right some of the time.

No one likes watching their hard-earned savings being eaten up by a declining market or the fearfulness that comes with it. These anxieties drive fight-or-flight behavior that is not entirely rational, but is understandable because it is hard-coded in our brains.

Research also shows that humans tend to be overconfident about their own abilities. So, despite the weight of the evidence against market timing, some will believe that the evidence does not apply to them. They can prevail where others have failed.

There is no shortage of asset managers who insist they can successfully time the markets. Many seem credible and some may actually be able to point to successes they have had in doing so. They may truly believe that they have discovered a valid timing process.

But the line between luck and skill in asset management is hard to discern, even for those doing the managing. There are many examples of asset managers who were lauded as market geniuses after great runs of performance only to crash and burn for equally long periods.

Were they skillful or just lucky? Since many market timers make calls infrequently, it takes years to find out. In any case, the evidence argues that any successes they have had are unsustainable over the long-term.

The case of Paul the Octopus is illustrative. Paul was a common octopus whose owners used him to predict the outcomes of international soccer matches. He would be given two bowls of food, each marked with a team’s flag. Whichever bowl he ate from first would be the winner.

He correctly “predicted” the outcomes of all seven of Germany’s 2010 World Cup matches and the eventual winner – Spain. His overall record was 12 correct predictions out of 14. He became a world-wide sensation for his prowess as a prognosticator. Pretty good for an octopus.

We desperately want to find a silver bullet that eases the pain associated with living through a down market. We might even convince ourselves that we could make all the right moves where others have failed. Or we convince ourselves that there is an expert who can do that for us.

Resist. The odds are stacked overwhelmingly against you.

Why timing the market is so hard

A major obstacle to successful market timing is the fact that the stock market’s long-term returns are driven by a relative handful of very good days. If you miss them while you are sitting on the sidelines, your portfolio’s performance could be decimated.

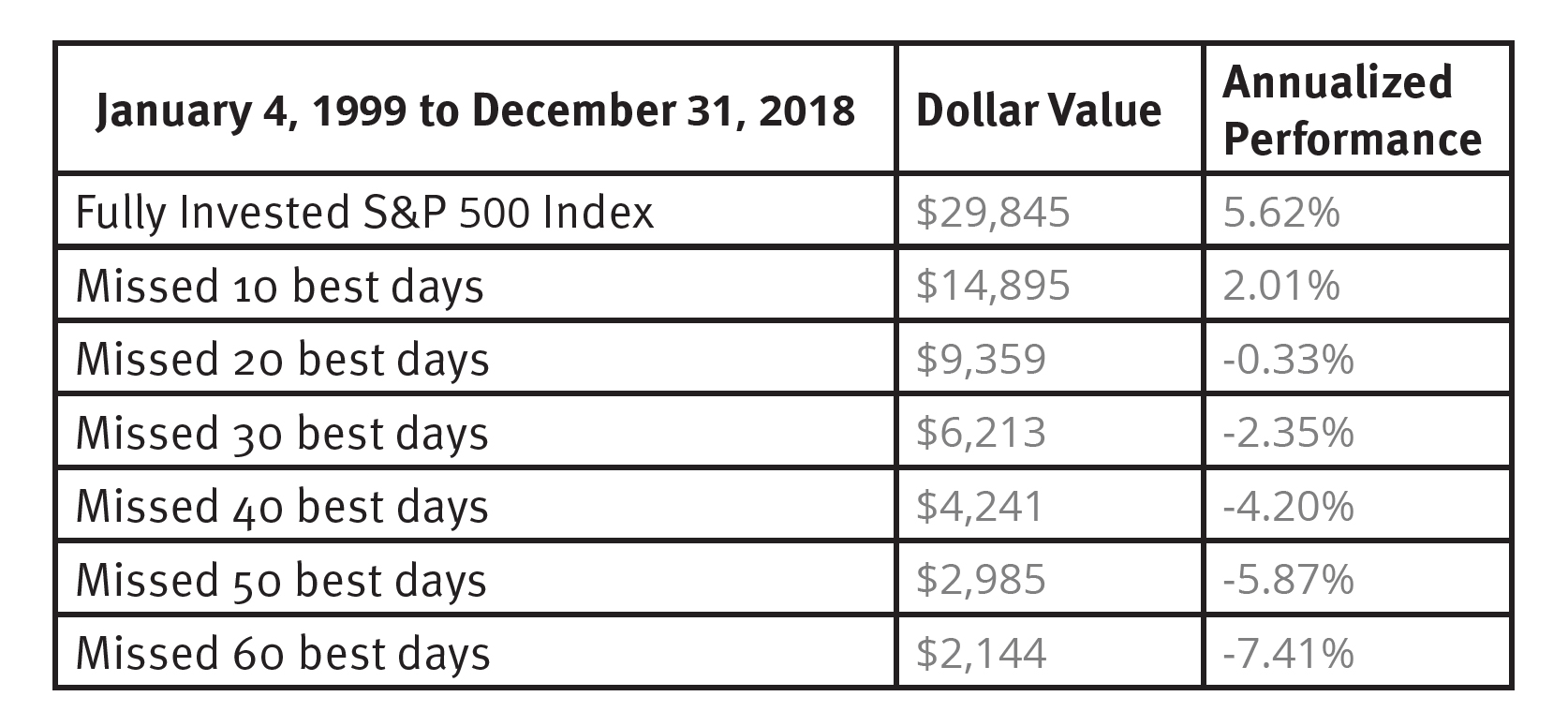

The following graphic illustrates the point. It looks at an investment of $10,000 in the S&P 500 over the 20 years from 1999 through 2018, a period that includes over 5,000 trading days.

Effect of Best Market Days

1999-2018

Source: JP Morgan

Anyone who remained fully invested during this period would have had an annualized return of 5.62%. Not bad for a period that included the Tech Bubble and the Great Recession.

But missing just the 10 best days (0.2% of the total trading days) would have cut that return by more than half. Missing the 20 best days (0.4% of the total trading days) would have resulted in a negative return for the period. Less than one-half of one percent of the total trading days determined the difference between a solid positive return and a loss.

That’s a small target to hit. A market timer must not only correctly call each market downturn, but then must also precisely time getting back into the market to avoid missing the handful of best days that ultimately provide most of the market’s positive performance.

And to make it even harder

To compound the problem, the best and the worst days in the market tend to be clustered in narrow time periods. According to the J.P. Morgan study, six of the 10 best days occurred within two weeks of the 10 worst days.

Research cited by Wim Antoon found that for the period December 1927 through December 2015, the average gain during the first three months after a market downturn was 21.4%.

So, at just the times when market timers are most likely to be out of the markets – periods following significant market downturns – the market also produces some of its very best returns. Missing even a small number of those precious days negatively impacts performance.

That is why successful market timing is so difficult and why Jane Bryant Quinn famously said, “The market timer’s Hall of Fame is an empty room.”

Out of focus

The market timer’s focus on missing the bad days puts the focus in the wrong place. Since the market goes up roughly two out of every three years, it is far more important to be in the market when it is rising than to avoid the more infrequent periods of market decline.

Since 1926 there have been 11 bear and 12 bull markets. The average bear market lasted 1.3 years. The average bull market lasted 6.6 years. Average losses from bear markets were a cumulative -38%. Average gains from bull markets were a cumulative 335%. (Source: First Trust Advisors, L.P., Bloomberg, 1926 through September 30, 2019.)

Bull markets last far longer than bear markets. The losses in bear markets are much smaller than the gains in bull markets. Painful as it may be, you are better off suffering through the down markets than missing the longer, stronger up markets.

The consequences of failure are severe

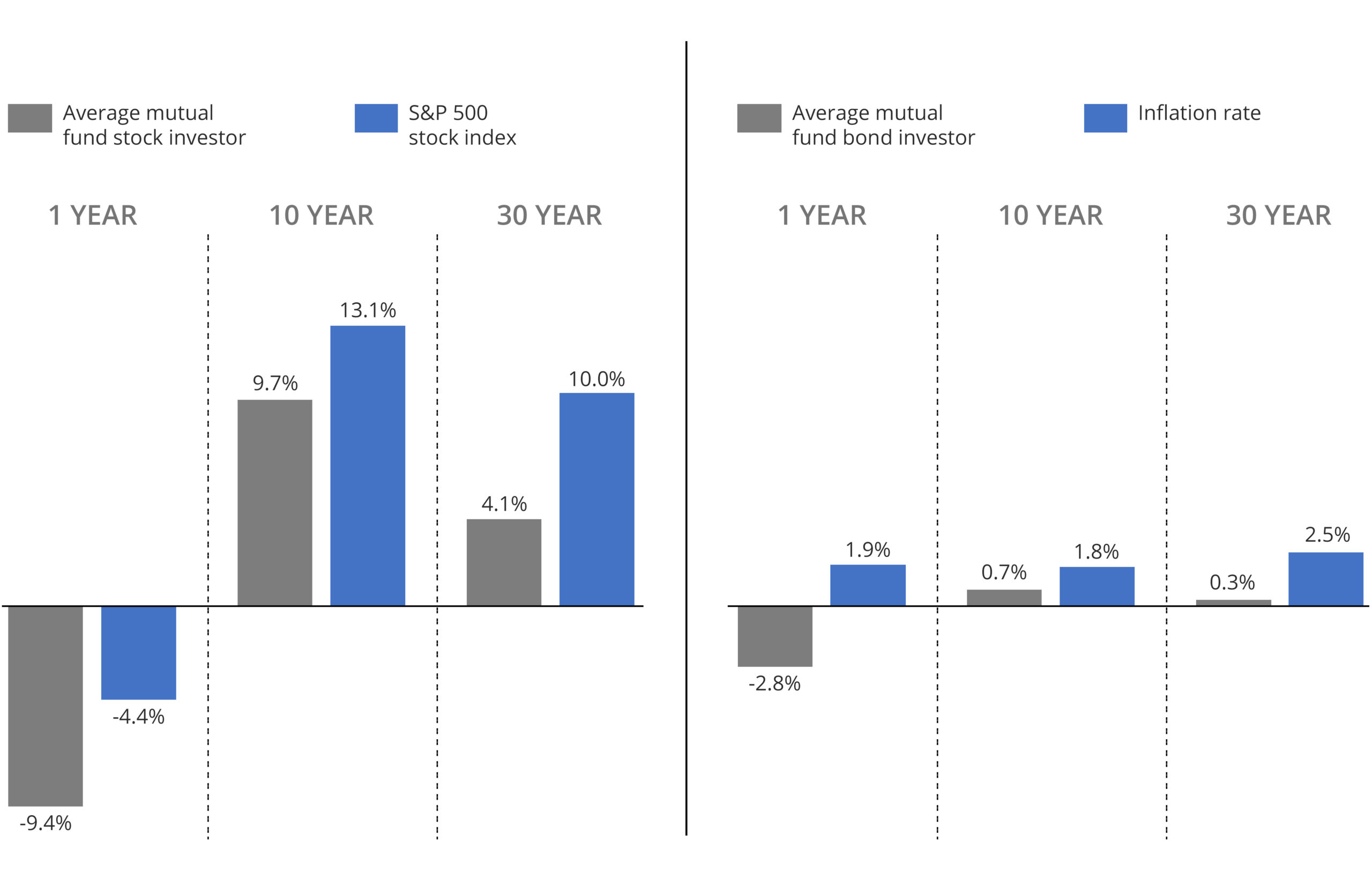

What happens when people ignore the warnings against market timing and give in to their emotions, behavioral urges, and the siren songs of the gurus? The 2018 Dalbar Quantitative Analysis of Investor Behavior Study gives us a pretty good idea.

Dalbar has been studying the behavior of mutual fund investors for 25 years. Every year the results are the same (although its methodology has been criticized). The average stock mutual fund investor has lagged the stock market and the average bond mutual fund investor hasn’t even kept up with inflation.

Dalbar attributes these results largely to investors’ tendencies to try to time the market. Not surprisingly, they aren’t very good at it.

The 2018 Dalbar study shows that stock mutual fund investors have underperformed the stock market over the past 1-, 10-, and 30-year periods. The outcome is the same no matter what time periods you examine. Bond mutual fund investors fare no better.

US Stock Mutual Funds vs. US Bond Mutual Funds

Annualized Returns

By the New York Times. Source: Dalbar.

Market timing is not only impossibly difficult, but it is costly too. Every purchase or sale generated by a timing call comes with potential transaction and tax costs. These costs will vary depending upon the nature and frequency of the timing-driven purchases and sales. But they add up over the years. Buy-and-hold investors avoid the lion’s share of these costs.

Control what you can control

Being a successful long-term investor can be hard work. Declining or volatile markets can create strong emotional reactions. Prolonged periods of poor market performance can tax the patience of even the most grounded individuals. The temptation to “do something” is great.

You can’t control the direction of the markets, but you can control how you react to them. Avoid the errors that have proven so costly to so many. Don’t let yourself fall into the timing trap. It cannot be done successfully on a consistent basis and efforts to do so can be costly.

Yes, markets go up and markets go down, but successful investors are patient. They know the key to long-term financial security is riding out the bumpy periods and reaping the rewards that markets have always delivered. It’s a tried and true method that has worked over the decades.