First Quarter 2018 – What a Ride…or Was It?

At First Ascent, we take a long-term view towards investing, believing shorter-term moves in the markets are unpredictable and mostly just noise. The first quarter of 2018 was a great example of why we believe this. As a result, I advocate what I call the “Rip Van Winkle” approach to long-term investing.

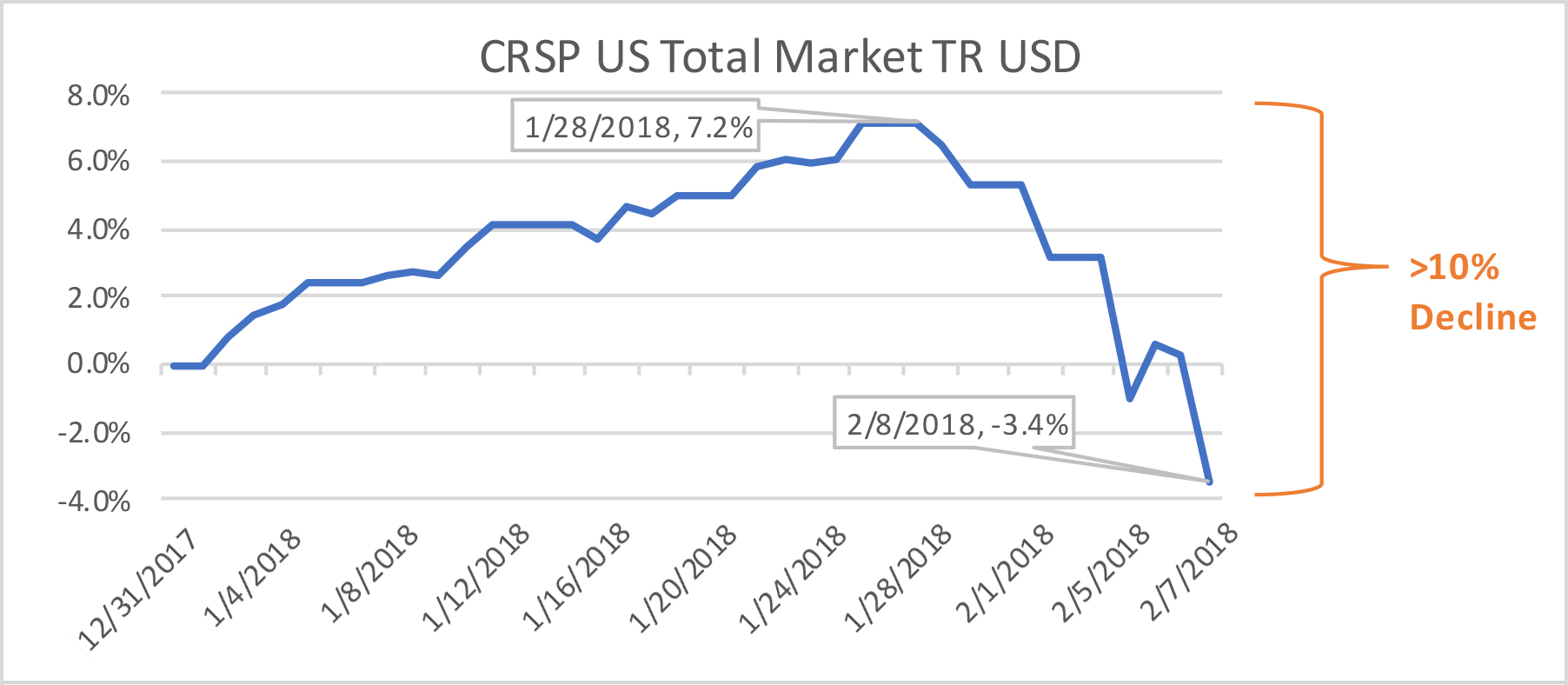

After an incredibly unique 2017 with record low volatility and no equity market drawdowns to speak of, the first quarter of 2018 brought a return of both. January saw an incredibly strong start, with US markets gaining over 7%. In early February the market experienced the first correction (-10%) we have seen since early in 2016.

(Return Data from Morningstar Direct)

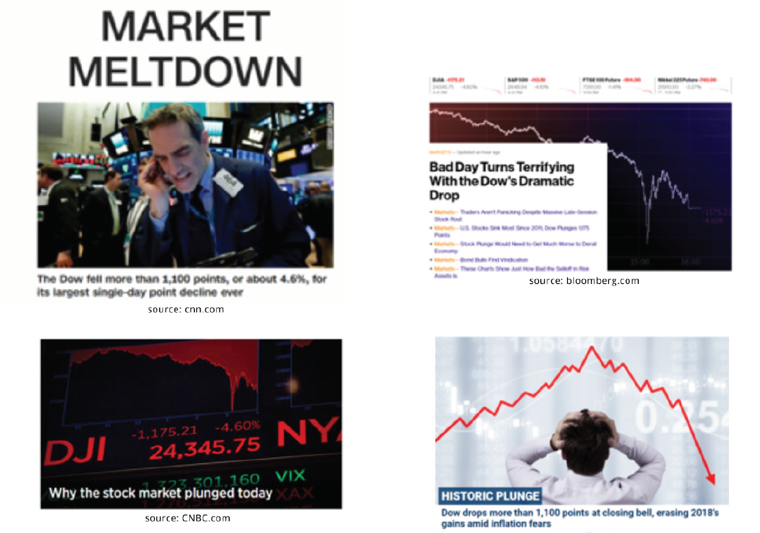

News outlets were going haywire, headlines were downright scary, and there was a lot of worry. I took the opportunity to capture screenshots of several major media websites during early February (my recommendation is to pay no attention to these apart from entertainment/educational value):

Terrifying, right?

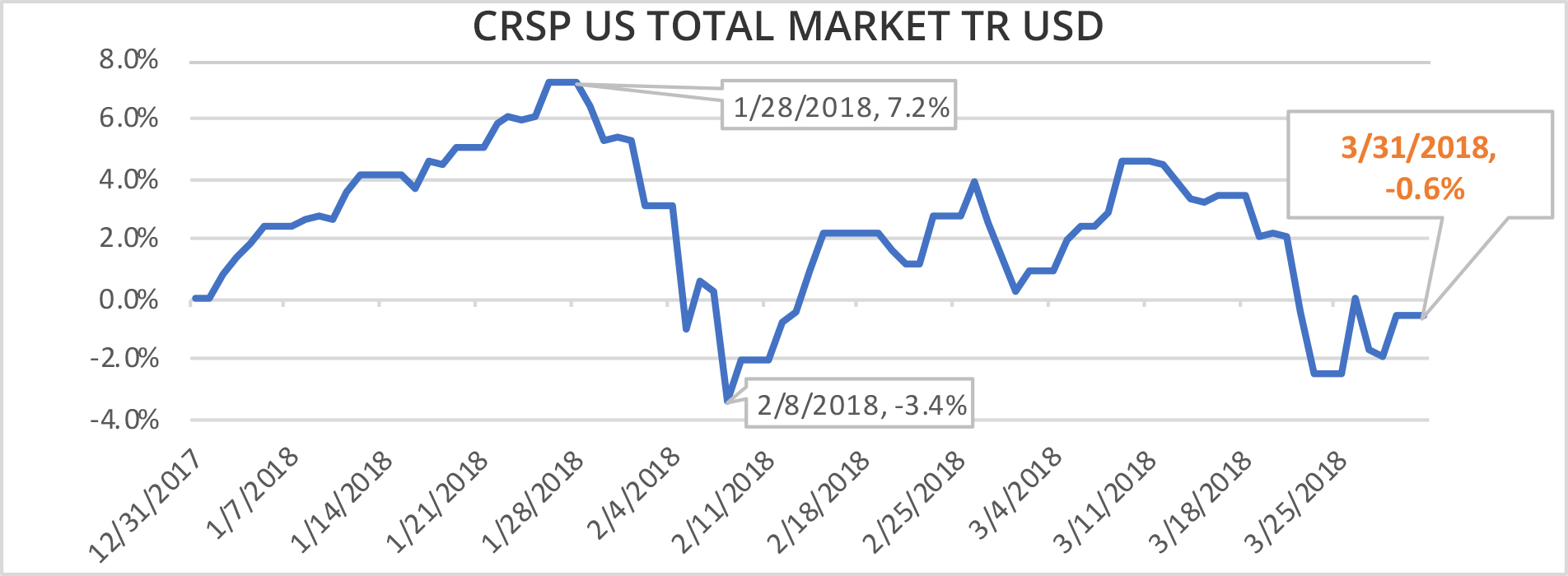

In isolation, perhaps. But let’s take a quick step back and think about things in a different light. We had just finished what was a record year in equity markets. The market came out stronger than anyone expected in January, and then reverted.

Throughout the rest of the quarter, markets bounced around, gaining and losing (albeit in larger magnitude than we were used to over the recent past). Overall, when the quarter finished, US stocks gave back a measly 0.6%.

(Return Data from Morningstar Direct)

Think for a minute about the anxiety difference between the investor who watched every daily fluctuation in the market throughout the quarter vs. the one who just looked at their portfolio at quarter end, to see essentially a “non-event” for the first quarter. This is what I call the Rip Van Winkle approach.

“Rip Van Winkle” is a short story by American author Washington Irving published in 1819. It follows a Dutch-American villager in colonial America named Rip Van Winkle who falls asleep in the Catskill Mountains and wakes up twenty years later, having missed the American Revolution. (https://en.wikipedia.org/wiki/Rip_Van_Winkle)

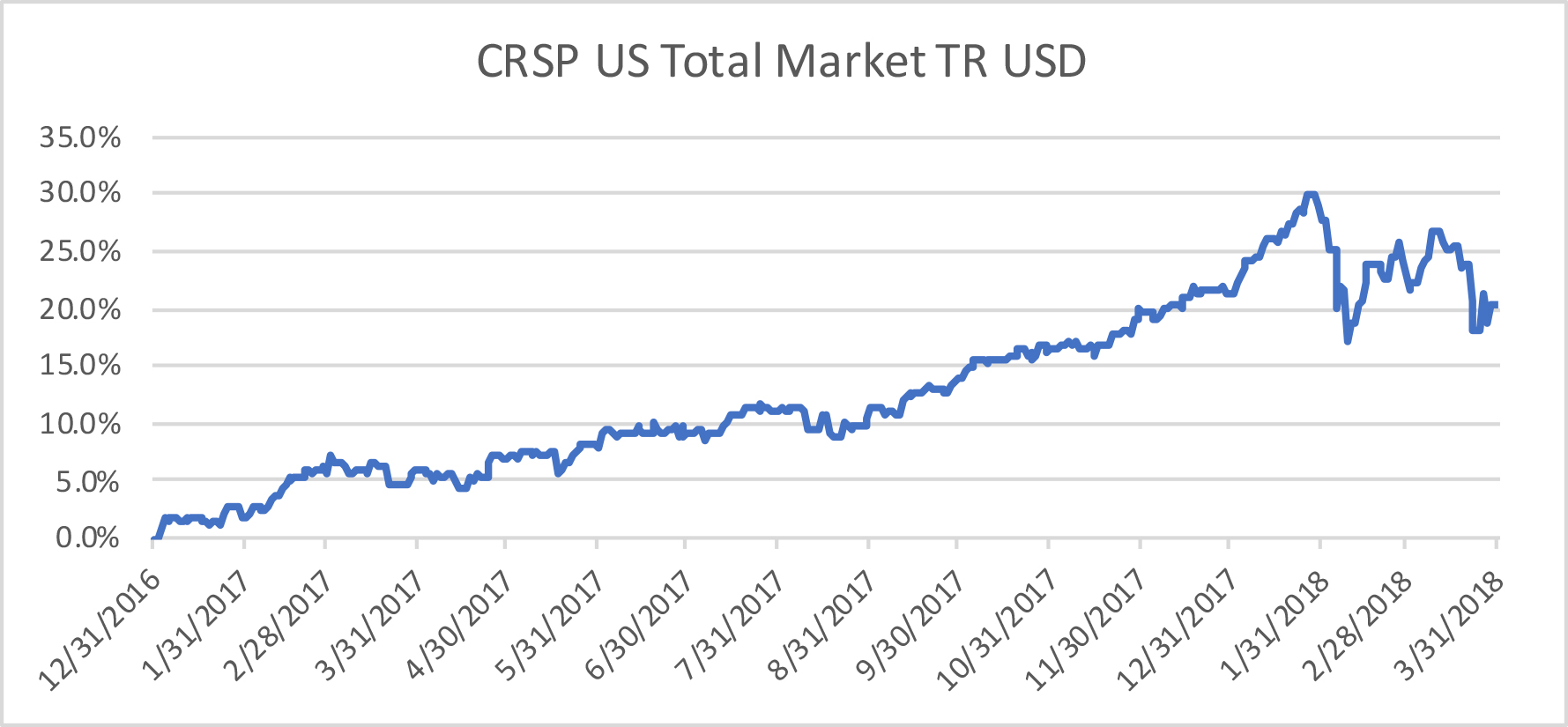

Oftentimes, investors would be best suited to take a nap and check back at some point in the future. Maybe even a long nap. Take, for example, an investor that fell asleep at the beginning of 2017 and woke up on March 31st 2018. That investor, as opposed to being stressed out and anxious by the recent market volatility, actually awoke to a wonderful surprise, with the US equity market gaining roughly 20% while they snoozed soundly. Every headline and market disruption this investor didn’t see, was one less mental hurdle to overcome in their journey to reaching their goals.

(Return Data from Morningstar Direct)