A Little Perspective

Given the market activity we have experienced recently, we thought it would be a good opportunity to share our views and hopefully provide a little useful perspective and insight. In short, we really view this as a natural and probably necessary pullback in the markets. Through September 30th, US stocks were up more than 17% over the past year and a pullback was inevitable at some point.

We do not try to predict or manage portfolios to avoid market declines, as we firmly believe they are not predictable. While not predictable as to timing, we also know they are inevitable. Market volatility and corrections are part of what contributes to positive expected return premiums for stocks. At times like this, we try to remind investors of the importance of focusing on the long-term and trying hard to tune out the short-term noise.

We recognize that as investors, we are all facing a barrage of influences that may push us off track, with the news networks being a key source. We pulled down a handful of screenshots from various websites on Wednesday, October 10, as an example of what we are up against as we seek to serve and educate our clients.

It is important to note that these sites have their own agenda and goals. Their objective is to pull readers into their websites, read their articles, get clicks, and earn advertising revenue. Helping investors reach their long-term goals is not their priority.

The language and images play on the fears and anxieties of investors. While these natural human reactions and impulses are useful in many situations, and worked to keep our ancestors safe from danger, reacting to them in relation to an investment strategy has proven to be detrimental to investors.

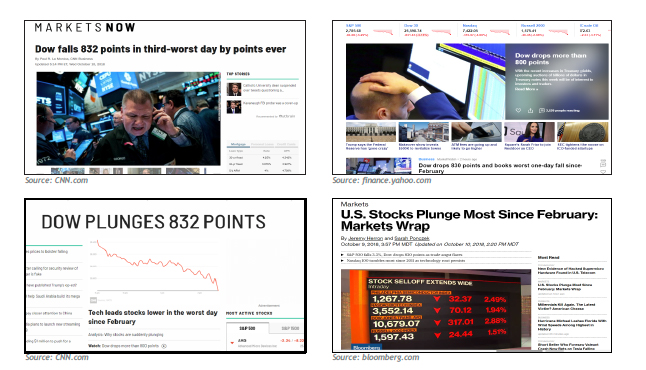

For some perspective, taking a step back and looking at the drawdown in the context of the last year, we see that last week’s move takes the Dow essentially back to where we were in the middle of August.

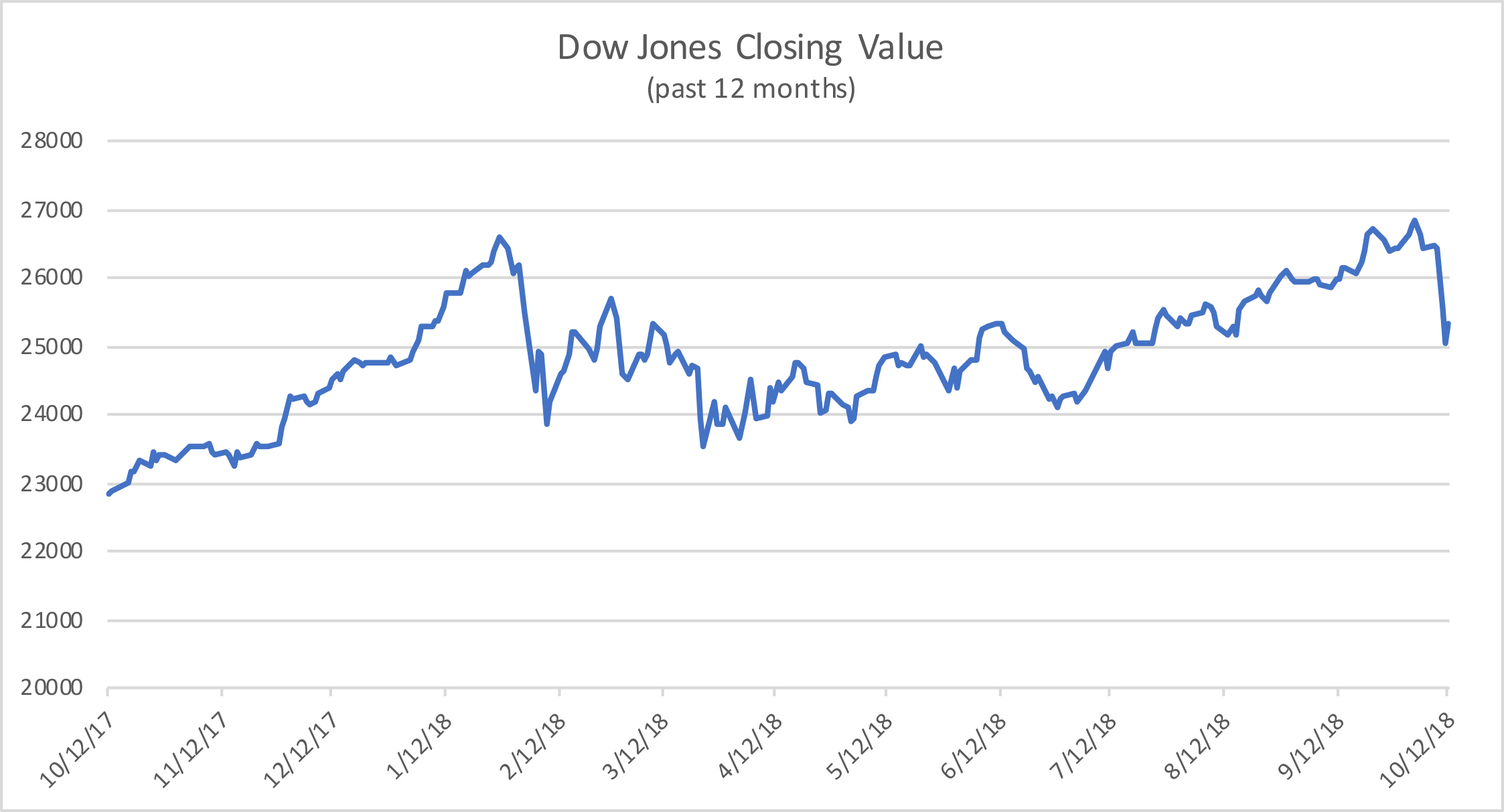

This is a longer-term view, showing various crises, concerns and issues that were driving headlines through time. The point is that there is always a reason to be fearful in the markets, but patient investors have been rewarded over time.

It has certainly been a challenging few weeks for markets, and it won’t be the last challenging period. As to where we go from here? The truth is that we don’t know, and we don’t believe anyone can know.

We could rebound sharply from here or continue to fall further. We do know that history tells that investors who are able to focus on the long-term, follow a well-designed and thorough investment process, and resist the base-level instinct to panic will ultimately be rewarded.