The Challenge of Being Independent – And What to Do About It

April 11, 2019 | By Katherine Clark

I get to sit in one of the best seats in our profession. My job is to support the financial advisors who decide to work with First Ascent. What that “support” looks like varies widely, from coaching on how to explain our portfolios to clients, to answering nitty gritty questions, to acting a

I get to sit in one of the best seats in our profession. My job is to support the financial advisors who decide to work with First Ascent. What that “support” looks like varies widely, from coaching on how to explain our portfolios to clients, to answering nitty gritty questions, to acting a

Business Builders

Two Newly Embraced Ideas, Thanks to First Ascent

September 27, 2018 | By Katherine Clark

Recently, a financial planner I really admire invited me to a group she was hosting at her office for women in financial services to elevate each other in their respective roles. After I gladly accepted the invitation, she emailed me again saying that the speaker for this month’s get-together ha

Recently, a financial planner I really admire invited me to a group she was hosting at her office for women in financial services to elevate each other in their respective roles. After I gladly accepted the invitation, she emailed me again saying that the speaker for this month’s get-together ha

Business Builders

Making Business Networking Work for You

April 3, 2018 | By Katherine Clark

“The old adage is wrong,” a professor at my business school would say. “It’s not about who you know; it’s about who knows you.” He would go on to posit that a few deep connections with people who truly know and trust your character can be more valuable than dozens of industry acquaintan

“The old adage is wrong,” a professor at my business school would say. “It’s not about who you know; it’s about who knows you.” He would go on to posit that a few deep connections with people who truly know and trust your character can be more valuable than dozens of industry acquaintan

Business Builders

Is Outsourcing Right for You?

February 6, 2018 | By Katherine Clark

Ask Yourself These 3 Questions to Find Out We offer outsourced investment management with a high level of service that we believe is worth far more than our low, flat fee. But even so, outsourcing might not be for everyone. When advisors who haven’t outsourced before contact us, we talk a lot abou

Ask Yourself These 3 Questions to Find Out We offer outsourced investment management with a high level of service that we believe is worth far more than our low, flat fee. But even so, outsourcing might not be for everyone. When advisors who haven’t outsourced before contact us, we talk a lot abou

Business Builders

What Your Clients Want to Know

December 5, 2017 | By Katherine Clark

We recently came across a blog post that Jason Zweig of the Wall Street Journal wrote about 19 questions clients should ask their advisor. As I read through the article, it seems to me that the one concern driving many of the questions is: How do I know I can place my trust in you? Business Builders

We recently came across a blog post that Jason Zweig of the Wall Street Journal wrote about 19 questions clients should ask their advisor. As I read through the article, it seems to me that the one concern driving many of the questions is: How do I know I can place my trust in you? Business Builders

The Spotlight Hog

October 3, 2017 | By Katherine Clark

Lately, we’ve been thinking that maybe our $500 flat-fee pricing model is a bit of a spotlight hog. Please don’t get us wrong. We are thrilled to be able to offer a low, flat fee. We believe strongly that our pricing model serves our advisors and their clients well. It allows us to fit more

Lately, we’ve been thinking that maybe our $500 flat-fee pricing model is a bit of a spotlight hog. Please don’t get us wrong. We are thrilled to be able to offer a low, flat fee. We believe strongly that our pricing model serves our advisors and their clients well. It allows us to fit more

Business Builders

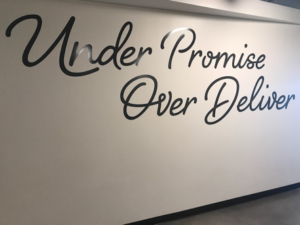

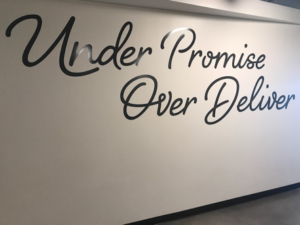

Why “Under Promise, Over Deliver” Can Hurt Your Business – And What to Do Instead

July 5, 2017 | By Katherine Clark

Our First Ascent offices are in a hip space right in the heart of Denver. The building is called INDUSTRY because developers converted an old, industrial warehouse into creative office space. This image captures what’s on the wall across from our First Ascent area: “Under Promise Over Deliver.�

Our First Ascent offices are in a hip space right in the heart of Denver. The building is called INDUSTRY because developers converted an old, industrial warehouse into creative office space. This image captures what’s on the wall across from our First Ascent area: “Under Promise Over Deliver.�

Business Builders

4 Things Clients (Really) Need in Their Advisor

May 9, 2017 | By Katherine Clark

What do clients really need from you? Do they need your alpha potential, your superior stock-picking skills, or your heavy-lifting on fund strategies? Maybe. And certainly, no client is going to complain when you beat the market (as long as you can do it again). But there may be some things you can

What do clients really need from you? Do they need your alpha potential, your superior stock-picking skills, or your heavy-lifting on fund strategies? Maybe. And certainly, no client is going to complain when you beat the market (as long as you can do it again). But there may be some things you can

Business Builders

I get to sit in one of the best seats in our profession. My job is to support the financial advisors who decide to work with First Ascent. What that “support” looks like varies widely, from coaching on how to explain our portfolios to clients, to answering nitty gritty questions, to acting a

I get to sit in one of the best seats in our profession. My job is to support the financial advisors who decide to work with First Ascent. What that “support” looks like varies widely, from coaching on how to explain our portfolios to clients, to answering nitty gritty questions, to acting a