4 Considerations for Separating Gimmicks from Investment Opportunities

I spend many of my days looking at, reviewing, and—far more often than not—dismissing new investment funds and ETFs. One of the words that often comes to my mind upon initial review of some of these investment ideas is: “gimmick.”

Merriam-Webster defines a gimmick as “a trick or device used to attract business or attention.” So, I stop and ask myself is there any merit to the strategy? Or is this just a marketing gimmick based around a recent hot topic, trend, or fear that is present in the world?

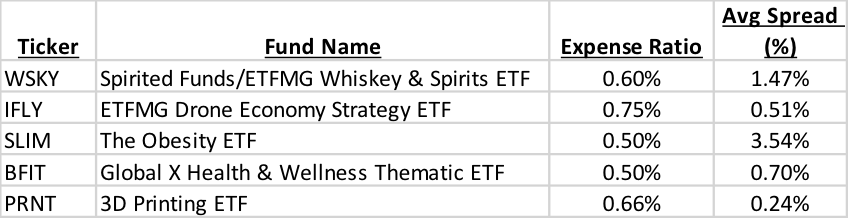

A few examples follow. In full disclosure, I have not done a full due-diligence review of these funds, so I do not have a strong opinion on the merits of any strategy listed. I am simply using these as examples of some of the types of strategies out there that come packaged in a thematic manner.

Source: ETF.com

From an initial glance, they appear sexy and one could easily develop a plausible narrative about why to invest. And what great tickers!

However great the narrative, though, this is simply not enough to make an investment decision. Thematic ETFs may have a place in portfolios if someone has a very strong view regarding the future global trends in the world. However, there are a few key questions that need to be asked before making an investment, and for that, you must dig deeper into the funds.

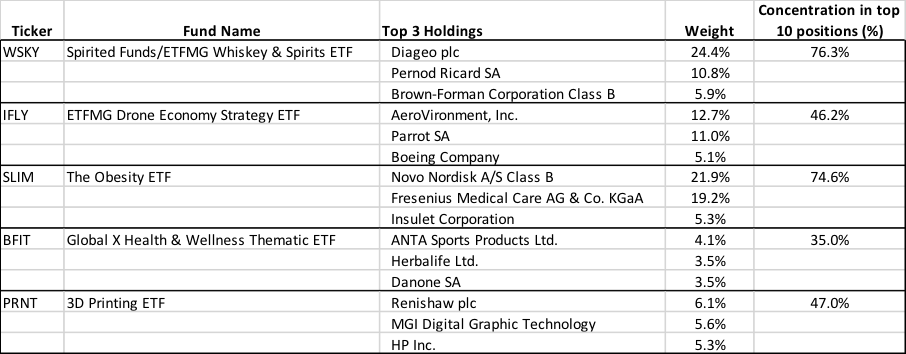

Here is a quick look at the top holdings and concentration of these funds:

Source: ETF.com

The following are 4 key questions to ask yourself about a fund that may help you decide whether the fund meets your needs or is a gimmick.

1. Regardless of name, does the fund actually provide the exposure to what you desire? Or are you exposing yourself to unintended risks?

For example, the third largest position in IFLY is Boeing. What percentage of Boeing’s revenue actually comes from drones, and will that really be a driver of its performance? Or might Boeing be more correlated to commercial airplane orders and defense contracts?

The largest position in PRNT is Renishaw PLC, a midcap company out of the UK. Will a midcap UK stock’s performance be affected by something like Brexit?

SLIM, according to Morningstar, is invested 85% in the healthcare sector. Is that a risk you are comfortable with? What is the risk of future regulations, and might that outweigh any thesis you have around the benefit the companies can derive from trends in obesity.

2. What is actually held within the fund, how concentrated is it, and what are the rules/guidelines for how the underlying index is defined?

Other considerations investors should think about are issues like: Is it market-cap-weighted, equal-weighted, or some other weighting scheme? Is it US-focused, or global? Are there sector, size, or liquidity constraints?

WSKY holds nearly one quarter of its assets in Diageo. I am not saying that is good or bad, but an investor better be comfortable with it and understand that Diageo’s performance is likely to dominate the outcomes of the ETF.

3. Is this the most cost effective/efficient way to express your view?

Each of the funds on this list have expense ratios above 0.50% and material bid/ask spreads. For reference, VTI, the Vanguard Total Stock Market fund, has an expense ratio of 0.04%, and an average bid/ask spread of 0.01%. There are also many relatively inexpensive sector funds available.

4. Do you have a strong belief that whatever trend/view you want to express has not already been priced into the underlying securities?

As with any active investment decision, you have to decide if the view you believe is already factored into the price. As we know, being right about something means nothing if everyone else has already agreed. SLIM currently trades at P/E ratio of 45. Have the future growth prospects already been priced into the underlying positions?

While ETFs can be a tremendous tool for investors, and offer many benefits, they are not all created equal. At First Ascent, we believe any deviation from a market-cap-weighted portfolio is an active decision that requires tremendous conviction, understanding, and research. Investing based on gimmicks, stories, and unintended bets is not the solution for long-term investment success.